Items that are not Perishable in nature use LIFO method ie coal 4In united states LIFO is use for tax reportingBut FIFO is used in financial accounting. LinkedIn with Background Education.

Cost Accounting Cost Accounting Accounting Accounting Education

Products are assumed to sell in the order theyre added to the inventory meaning the first products in stock are the first to be sold.

List of companies that use fifo. The FIFO method is the standard inventory method for most companies. One Cups cost of goods sold COGS differs when it uses. Ad Get data and information on 3 Million companies.

The First-In First-Out FIFO method assumes that the first unit making its way into inventoryor the oldest inventoryis the sold first. Startups VC-backed PE-backed public. By using FIFO your company can ensure streamlined inventory practices and the use of materials which will always keep integrity through the life of your product.

Most businesses use the first in first out FIFO method. That buys coffee mugs from wholesalers and sells them on the Internet. For example lets say that a bakery produces 200.

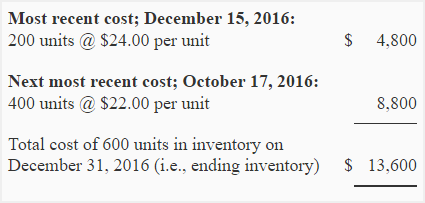

First-In First-Out FIFO Under FIFO its assumed that the inventory that is the oldest is being sold first. Explore how the PitchBook company database can help you create detailed company lists. The FIFO method makes the most sense for businesses such as restaurants bakeries and butchers because the products have a shelf life.

So after selling 50 shirts. Donnas Doors started the month of May with 20000 in. With FIFO we use the costing from our first transaction when we purchased 100 shirts at 10 each.

COGS 50 shirts x 10 FIFO cost 500. In this situation if you sold each perfume for 2 each your revenue would be 20. IFRS disallowed LIFO and US GAAP allowed to use both.

Example of LIFO. The costs paid for those oldest products are the ones used in the calculation. Startups VC-backed PE-backed public.

Using the following example well be able to see how LIFO and FIFO affect the cost of goods sold and net income. FIFO gives a lower-cost inventory because of inflation. Example of LIFO.

Alternatively it would be 20 1250 750 under LIFO. Items that are Perishable in nature use FIFO methodie Vegitables 3. FIFO stands for First-In First-Out.

Lower-cost items are usually older. 50 shirts from the first purchase are still left on the shelves costed at 10 each as well as the remaining 200 shirts from the second purchase at. Suppose theres a company called One Cup Inc.

Its used in all types of industries from food catering retail pharmaceuticals and manufacturing. Ad Get data and information on 3 Million companies. The FIFO method assumes that the oldest products in a companys inventory have been sold first.

It is a method used for cost flow assumption purposes in the cost of goods sold calculation. Then your gross profit would be 20 - 10 10 under FIFO. First-in first-out FIFO is a valuation method in which the assets produced or acquired first are sold used or disposed of first.

Explore how the PitchBook company database can help you create detailed company lists. Your net income will be less and you pay less tax if you use LIFO during the rising inventory cost. Its essential for industries where people handle high amounts of products.

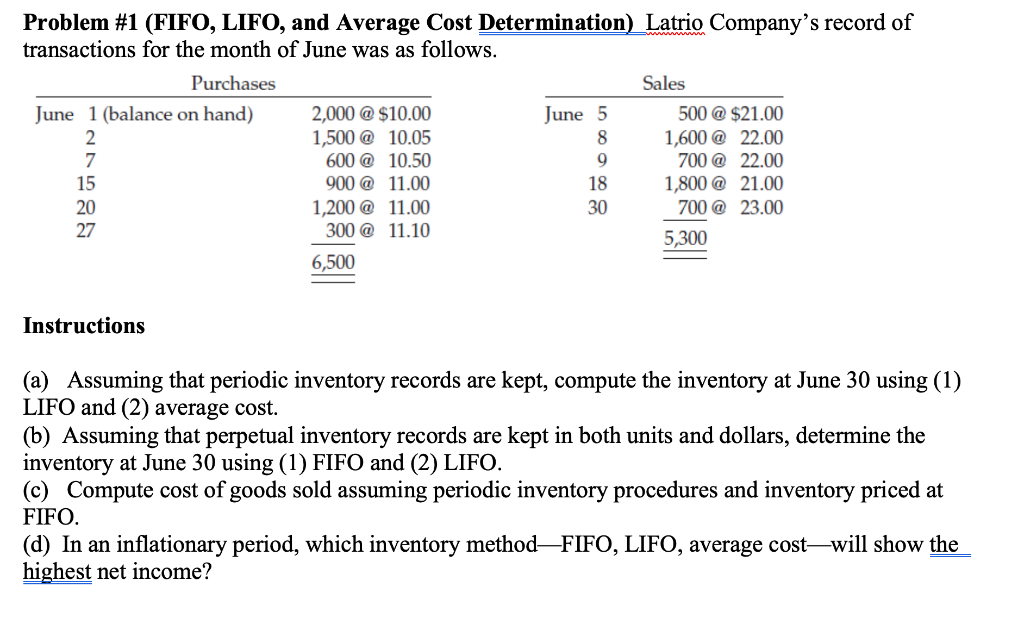

Problem 1 Fifo Lifo And Average Cost Chegg Com

Pdf Invetory Valuation Methods And Their Impact On The Company S Profit Generation

Inventory Management Tip Categorize Your Inventory Into The Most To Least Important Bonus Having An Invento Management Tips Tech Company Logos Company Logo

Choosing The Right Accounting System Fifo Vs Lifo

Inventory Valuation Pdf Cost Of Goods Sold Inventory Valuation

Accounting For Beginners 11 Fifo And Lifo Inventory Basics Youtube Accounting Lesson Beginners

Maxell Company Uses The Fifo Method To Maxell Chegg Com

Risk Management Techniques Management Techniques Risk Management Strategies

Why Would A Company Use Lifo Instead Of Fifo Online Accounting

20 Largest Lifo Reserves In Mm Download Table

Why Would A Company Use Lifo Instead Of Fifo Online Accounting

Cost Of Sales Templates 8 Free Ms Docs Xlsx Pdf Sales Template Excel Templates Cost Of Goods

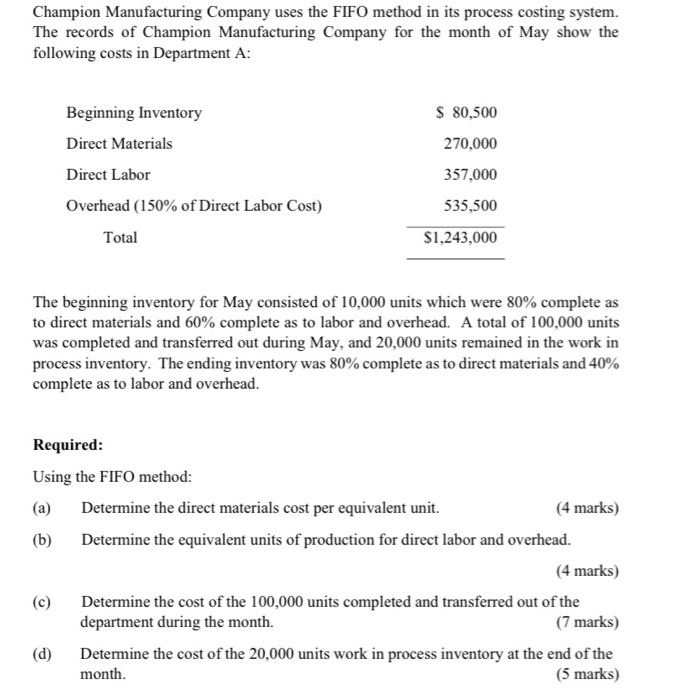

Champion Manufacturing Company Uses The Fifo Method Chegg Com

Taking Stock Of Your Stock Inventory Management 101 Blue Ocean Systems Singapore Sap Business One Hana Ocean Systems Management System

Keep Your Food Safe By Implementing Fifo First In First Out System Which Simply Means That The Food That Has Been In 2021 Food Wastage Cook At Home Expired Food

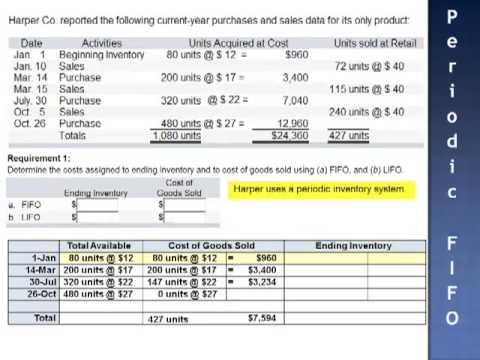

First In First Out Fifo Method In Periodic Inventory System Accounting For Management

Simple Pos Net Core 3 1 User Management Arabic Support Full Source Code By Afmelwekeel Ad Core Paid User Coding Source Code Web Based Application

Pdf Improvement Of Inventory System Using First In First Out Fifo Method

Fifo Vs Lifo Comparison Double Entry Bookkeeping